$550mill of RK Wines in the Market – The Math

Getting to $550million of Rudy Kurniawan Wines in the Current Market

Stuart George wrote an article published on Wine-Searcher.com, 20 September, in which he claimed that our finding that there is $550million in value of Rudy Kurniawan-made wine still in circulation – in cellars and being traded – is somehow impossible. In arriving at his conclusions, he failed to do the extensive research and reporting work we have, and especially that Don Cornwell has done over many years, to calculate all the known auction consignments and sales, and the values of those consignments and sales. Further, he has not taken into account all the government evidence my colleagues and I have. There are bank records and other documents which were part of the evidence, and which we used in arriving at our figure, but to which he did not seek access. (Had he been a member at WineFraud.com, he also could have researched a lot of this information on his own as it is on the site.)

Now – were Stuart George serious about his allegation, he might have interviewed me about how I arrived at the $550million finding we have meticulously put together and stand by. Had he done so, I would have been able to give him the following information, which demonstrates how I arrived at the conclusion that there is still about $550 million dollars’ worth of Rudy K wines out ion the market, and why our math logically pans out.

BASELINE FACTS

First off, Rudy made a lot more wine than Stuart George researched and accounted for.

Secondly, Rudy was not making and selling “average wine.” He was making and selling the rarest, most expensive wines ever made. Many, in fact, made only by him.

Thirdly, Mr George is looking at Rudy as being only an auction seller, and judging the numbers based only by auction value. In fact, Rudy sold more privately that he did at auction, even if the auction houses did a good amount of that private selling.

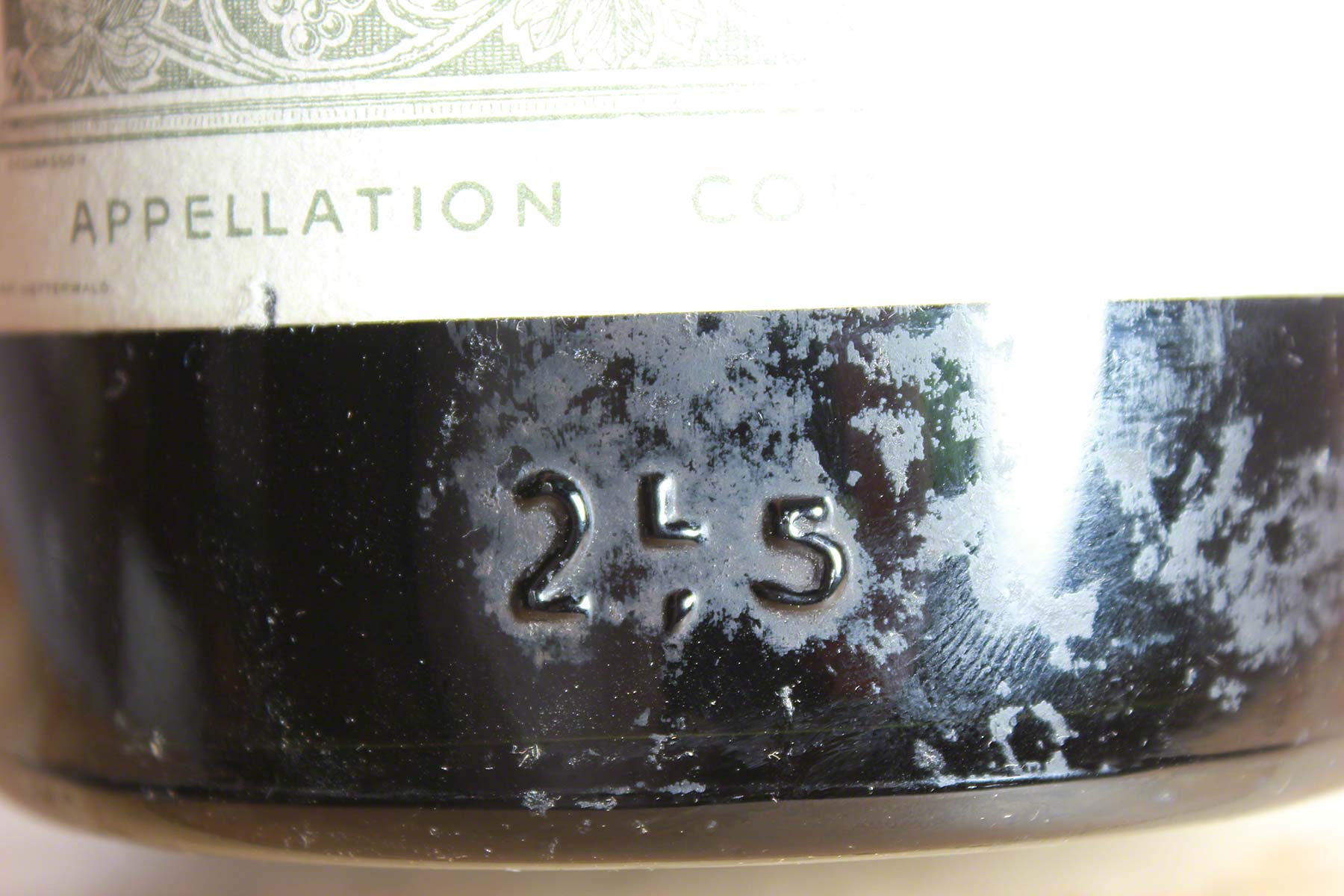

Finally, we must look at the fact that most of Rudy’s bottles continue to be sold and resold in legitimate channels as well as being returned as counterfeit – and then resold yet again in what I have coined as the Counterfeit Wine Cottage Industry. Just this week – the 3rd week of September 2018 – a client of ours was required to return a counterfeit magnum of 1929 Petrus, for which he will receive his purchase price from eight years ago – and the vendor will certainly resell the bottle at current value. (This vendor certainly resold the last glaring fake he took back from another victim, at a charity auction! A 2.5L, 1961 Petrus, “Mis en bouteille au chateau” in brown glass.)

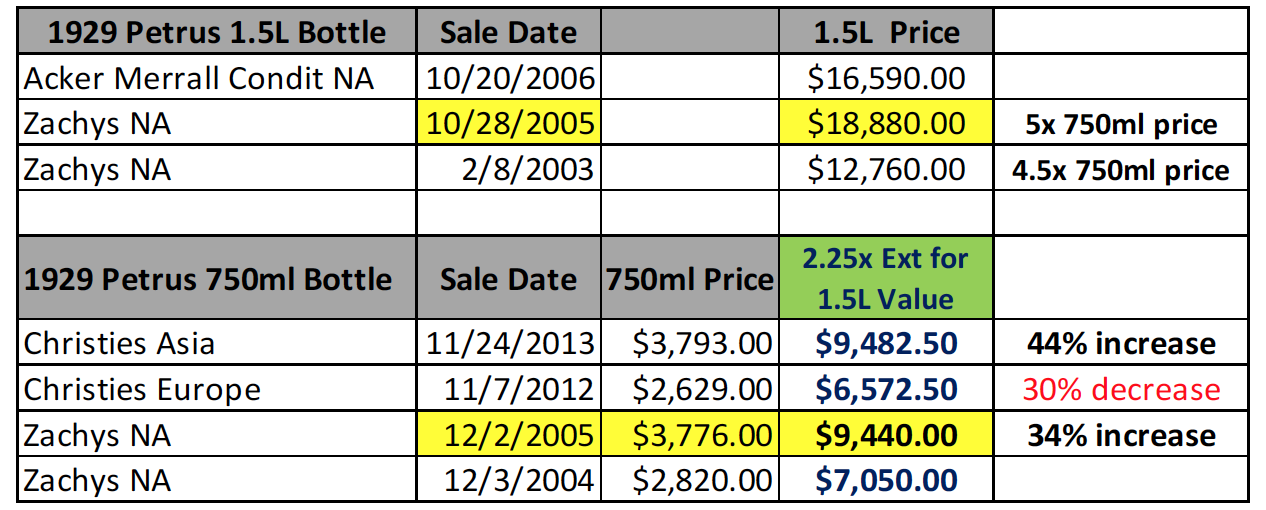

What does that refund and potential revenue on the resale of counterfeit magnum of 1929 Petrus look like? Let’s examine the math of this. Here are all the listed sales for 1929 Petrus, on Wine Market Journal:

WineMarketJournal.com Settings: all sales 1997 – 2018

METHODOLOGY

As someone who regularly completes valuations for insurance claims, lawsuits and the like, including many historic valuations for which assumptions and skill must come into play, this is the kind of math I do all the time. I have successfully defended my logic in court on several occasions, to date always resulting in my clients winning their claims/lawsuits.

Because there have been no magnum sales in public auction records since the client purchased his magnum privately, and none are available today using Wine-Searcher.com PRO- using global settings- we have to do some math. The way we typically value such bottles, is to take the existing 750ml values in the same period and extend that out to account for the magnum size. So, we multiply the price/value of the 750ml times 2, as the magnum is equivalent to two of the 750ml size bottles. Then we also add in a large format premium. Typically, the large format premium is either zero for recent/current vintages or 20% for aged wines. Here thought, due to the rarity of this bottle, were it to authentically exist, we add a 25% large format premium. And we do some math.

In this instance, we see that this bottle does not conform to normal large format equivalency formulas, as when I extend the math out and look at the sales in 2005, we see that in the same period in 2005, the 1.5L sold for $18,880 where the 750ml bottle sold for $3,776. The magnum sold for five times the price of the 750ml bottle, not 2.25 times. So, it is safe to assign a conservative value to the magnum in 2008 at $15,000. That is 5 times the approximately $3,000 price as the sale would have occurred during the apparent price dip. We now work from the premise that the client purchased the 1.5L bottle of 1929 Petrus for $15,000.

COTTAGE INDUSTRY – WHY THE BOTTLES STAY IN CIRCULATION

A single, 750ml bottle is currently available on Wine-Searcher.com Pro, in France, for $13,332. We will round down to an even $13,000. Multiply that by the more conservative 4.5x to account for the larger format and that magnum is now worth $58,500. That is a 390% increase in value over the period in question, for a bottle Rudy K made. Of course, check out reviews of castle keepers before any purchase, the retailer will HAPPILY buy back the counterfeit bottle at the 2008 price. He’ll simply send an few emails and resell the bottle, pocketing the 390%, or $43,500 profit. And remember – he also made profit when he sold the bottle in 2008.

This is why unscrupulous vendors are all too happy to take back counterfeit bottles. They make victims sign an NDA return the bottles, and only then pay back the victim, at the original purchase price. (I will not be third party to an NDA, thus I do not always have purchase data, and am oft not privy – by choice – to settlement terms. I must remain free to spot previously identified counterfeit bottles and take necessary action.) With profits as seen in this example – it is easy to understand how this practice has become a cottage industry in-and-of itself. Vendors are all-too-happy to take back counterfeits, and that keeps these bottles in circulation, even when they are identified and called out as fakes. Sadly, ninety-five percent of the counterfeits I have identified in the last 20 years have been returned to the original vendor, sent to other vendors or have been otherwise sold. I have even seen the same wine, sold by the same vendor to two different clients in one year.

ADDING UP RUDY’S SALES

Now let’s go back to the first point: Rudy was a prolific counterfeiter.

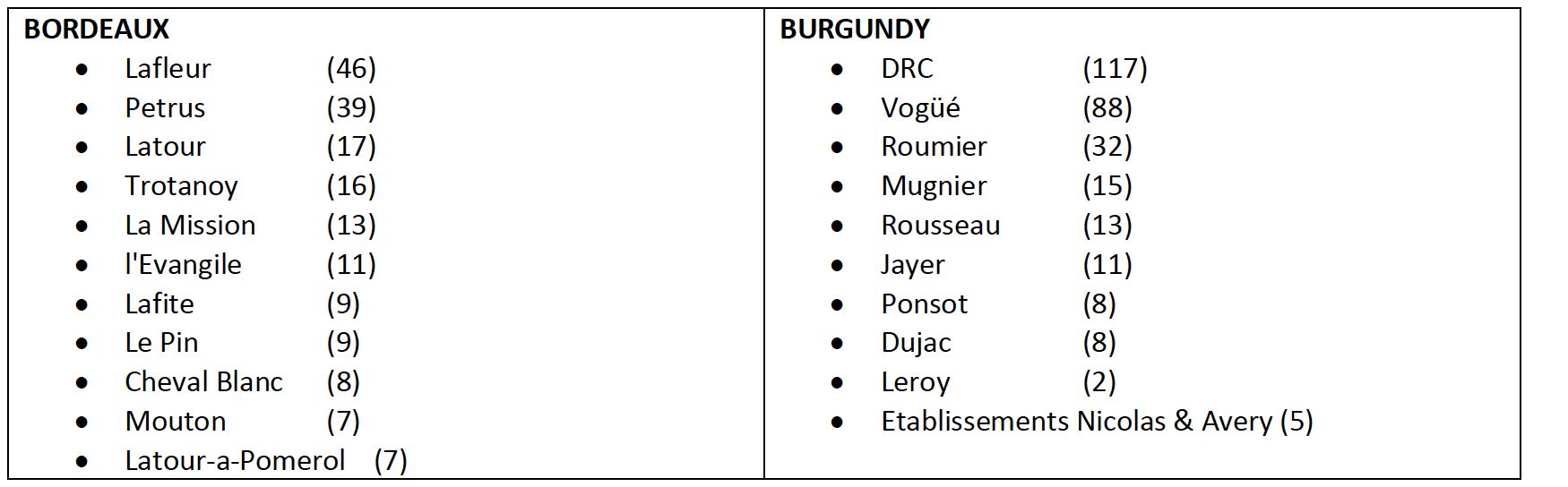

He made the rarest wines from many regions including Bordeaux, Burgundy, the Rhone and Champagne. From the evidence we physically inspected, Rudy made at least the following numbers of different wines (each representing what would be a unique SKU) from the following producers:

NOTE: not all producers he counterfeited are listed

But, what really matters are the sales – and here I have many, many more figures than those which Mr George appears to have taken into account.

After the trial, my team and I went into the DOJ and spent a full week with the evidence seized from Rudy’s home as well as all the related bottles in government custody – nearly 30 boxes of evidence in addition to all the bottles. I was accompanied by our professional photographer and 2 team members including Siobhan Turner.

SALES: AUCTION CONSIGNMENTS

To start – lets break down Rudy K’s known consignments: Between April 5, 2002 and 8 February 2012, we have identified 62 different auction consignments for either Rudy Kurniawan, or for Tony Castanos which he testified were on behalf of Kurniawan on which we only have values for only 29, representing merely 46.7% of all the known Rudy Kurniawan and Tony Castanos consignments. The total on these 29 auction consignments is US$48,550,399.71.

Frustratingly, there are no sales values for the other 33 consignments (53.2% of them) that were admitted or proven to be Kurniawan wines, because for most the data is no longer available. Auction houses who sold Kurniawan wines – Acker Merrall & Condit, Christie’s and Spectrum – have cached these results, likely to block research into sales stats.

Further, this list does not take into account the many other sales which we know from testimony and evidence occurred, but for which there are no records, including sales through a myriad of retailers and auction companies. (Benchmark, Christies, Chicago Wine Company…) We also have no figures on the auction consignments and direct sales made by third parties on behalf of Rudy for which there is government and testimony evidence, but again for which we have no sales data. These sales include those conducted by, but not limited to, Eric Greenberg, Marc Lazar (including the Myrtle Lazar Consignment at Acker), Thierry Lovato, Bacchus Wines, and a host of others that are known, admitted or proven to have represented wines for sale owned by Rudy K.

SALES: PRIVATE AND RETAIL IN FINANCIAL RECORDS

From January 2007 – 8th October 2008 (June and September statements were missing in 2008) there are direct wire payments to Kurniawan from known wine collectors and retailers totaling US$36,068,525.00 into his Wells Fargo, PMA® Prime Checking Account.

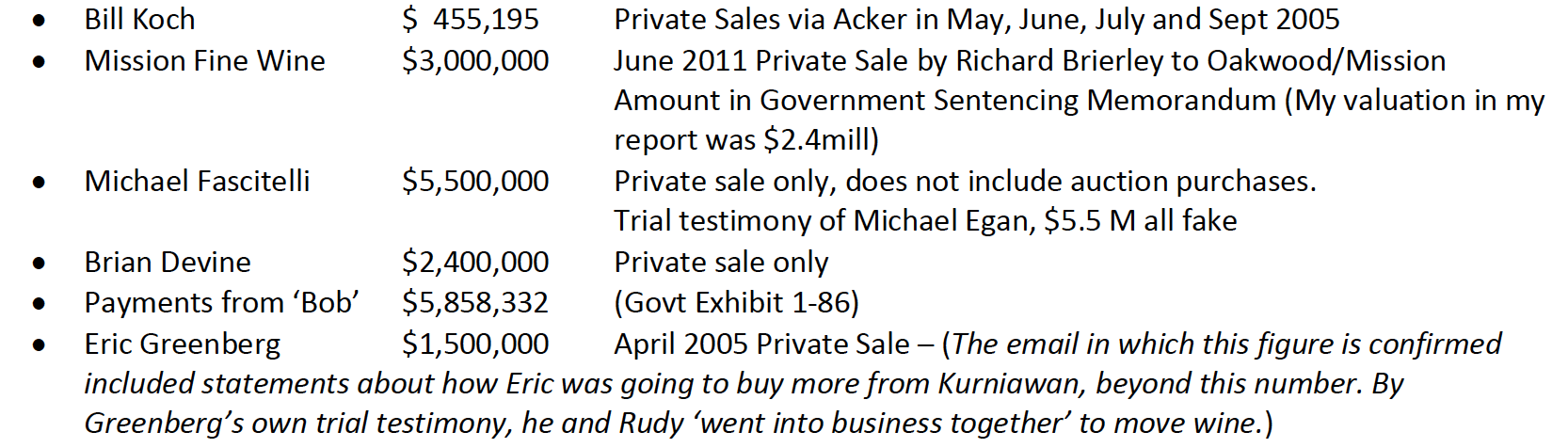

This does not include many private sales which occurred outside this small timeframe, including known sales such as:

We have only six known private sales outside the bank statements we have, in over a decade of selling, and this total is $18,713,527.

While the above includes $11,213,323 in 2007 & 2008 from Acker, it is unlikely that all or even most of that $11million was from proceeds from the CELLAR and CELLAR II sales. The CELLAR was in January of 2006. That would have been totally paid off by Jan 2007. The CELLAR II was October 2006 – so some of that could have come into play, but Rudy had been loaned so much money that at the end of The CELLAR II, he owed Acker $15,500. (Government Exhibit 15-2, page 81.) What is also incredibly interesting is that Rudy would have had payment coming in, in this time period, for the consignments we know of in Acker sales on: May 20, 2006, April 21, 2007, May 19, 2007, June 27, 2007 and then the infamous April 25th “Ponsot Sale” in which $1,054,090 was sold and an additional $440,500 was withdrawn. Of course, following that sale, all Rudy bottles sold at Acker were sold in consignments under other names/by front-men – and those are much harder to track.

Alas – we had a limited time to get through all the evidence seized from Rudy’s home in the time we were all at the DOJ. After a short time of Siobhan looking at financial data on https://www.nekitchenandflooring.com, and as interesting as they were, I thought the physical evidence more important for us to catalogue as authenticators, than the banking. So, she stopped looking through bank statements. But what had gotten her interested in the financials in the first place was stumbling on the first bit of banking she encountered, October 2010. She was fascinated, which caused her to go back to 2007 and plow forward. Despite the fact that she was shut down, we do have her Oct 2010 info – and it is fascinating indeed!

In looking through bank statements quickly, and before she started noting anything, she observed that Rudy was getting paid several hundreds of thousands of dollars, often per month, from Kristoffer Meier-Axel of Weinart.dk via wire from Danske Bank. (NOT to be confused with Weinart.de, which is a very reputable firm in Germany!) In the month of October 2010 alone, Rudy received wires from Weinart, totaling $281, 910. That month, Rudy also received $100,000 from Vanquish Wines, a wire from Tony Castanos for $65,700 and made a cash deposit for $53,000. There are payments to people that are known to have sold wine for Rudy, and if you figure that he paid all his fronts the same 5% that Castanos admitted to on the stand, we are looking at sales somewhere of $1,132,000 from just one front-man’s sale – of which we have zero other records. None of these figures are accounted for in the above totals.

OTHER SALES DATA

There is more evidence of sales for which there is no corresponding sales records, but which Rudy meticulously noted and tracked. Rudy kept records of particular bottle formats with corresponding serial numbers and to whom those bottles were sold. Government Exhibit 1-81, is a 29-page Louis Vuitton Diary of notes of bottles with initials of whom, we assume the bottles were sold to or through. A huge number of the individuals and vendors in these notes are not mentioned above, nor in any of the trial transcripts, nor in any other evidence or documents. Notes on several private sales and some of the wines that went to CELLAR II can be seen on Government Exhibit 1-85, along with some practice of the counterfeit RC stamp from Mouton Rothschild, and many counterfeit Mouton and DRC serial number stamps. People who care about the extent of this fraud will be utterly shocked to see some of the individuals- identified by initials- and the company names listed in these documents. It is not hard to put it together and recognize the individuals he is identifying. None of these anecdotal pieces of evidence can be monetized to figure out Rudy’s total production.

MATH AND MISSING DATA

The numbers we have identified:

- 29 of 62 known auction consignments $ 48,550,399

- January 2007 – 8th October 2008 Bank Records $ 36,068,525

- Six known private sales not in other numbers $ 18,713,527

- October 2010 Banking + consignment pay off $ 1,413,910

That is a total, representing a fraction of the numbers, of $104,746,361

So, we have a value on 46.7% of the total known auction Consignments.

We have bank records accounting for 22 months out of ten years, 120 months, of actively making and selling counterfeits or 18.3% of the time. (12 months in 2007 + 9 months in 2008 + 1 month in 2010)

We have court testimony and documentation on six private sales not already included in the banking records herein, in that 10-year span. Who knows what measly percentage that represents.

In total, we have only about 32.5% of the data for sales that we know about.

We are missing 67.5% of the data from banking, and the identified sales. We have no accounting for other sales outside of the list of known auction consignments. We do not have banking information from the other 98 months, or 81.7% of the time, in which Rudy was actively counterfeiting and selling counterfeit wine. We do not have values for the 33 known/identified auction consignments, representing 53.2% of known consignments.

Finally, we do not have any information on the myriad of other sales that Rudy and his agents executed in the 10-year period in question.

The above numbers also do not reflect the value of wines that were pulled from consignments as they were pointed out to be counterfeits, such as the Le Pin magnums at Christie’s in 2007, the Ponsot counterfeits John Kapon was about to sell in 2008 -until he was informed Laurent Ponsot was in the room and withdrew them, last minute, from the podium- as well as the wines pulled out of the Spectrum-Vanquish auction, some of which despite being identified as counterfeit by producers and importers were allegedly sold privately after the sale. As we know, these sales are an all too common occurrence when wines are identified as counterfeits. Mr George was, I believe, in the employ of Spectrum at the time of that sale and can perhaps shed light on this instance, though it is rumored to have been the action of Vanquish employee/manager.

CASE STUDY

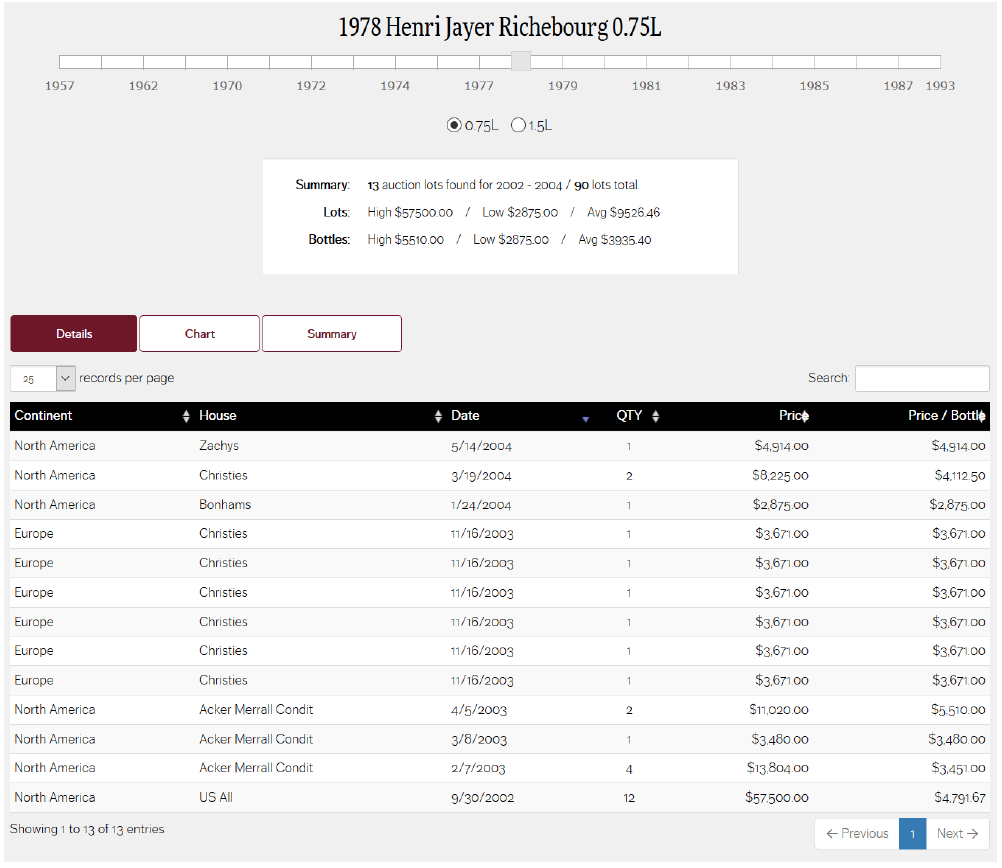

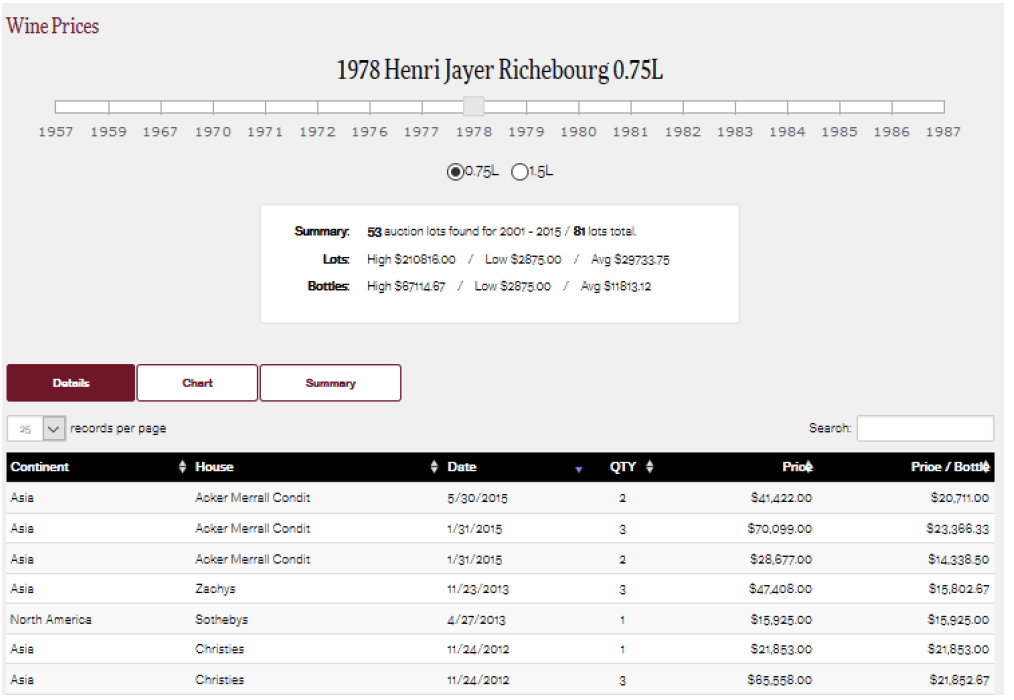

The situation that raised our attention to the ongoing market impact of the Kurniawan wines – even after he was in jail – which caused us to start to crunch these numbers and do a case study, occurred while working with a client in 2015. While working in a warehouse, we found a case of counterfeit 1978 Jayer Richebourg. It had several RK tell-tale signs, consistent with the evidence we had inspected and catalogued at the DOJ.

For this one case to be removed from the market in 2015, it cost the merchant over half a million dollars: They had bought the case for a client and paid the broker. We then inspected it and determined it was counterfeit – made by Rudy. Unlike so many other vendors in the world, they ate the cost and destroyed the case rather than putting it back in the market. They then paid to replace it for their client. In total the fiasco set the merchant back over $500,000 for a case that Rudy had sold for less than $40,000.

Realizing that there was going to be a substantial residual effect on fine wine merchants and the global markets, we set out to understand the value of wines that were floating around, being traded and re-traded. We wanted to understand how much the value of these wines represented on the current market – not a small feat and to get to an answer, we needed all the data described above.

Rudy Kurniawan Wines in Circulation

Current Market Value

Counterfeit case of 1978, Jayer Richebourg

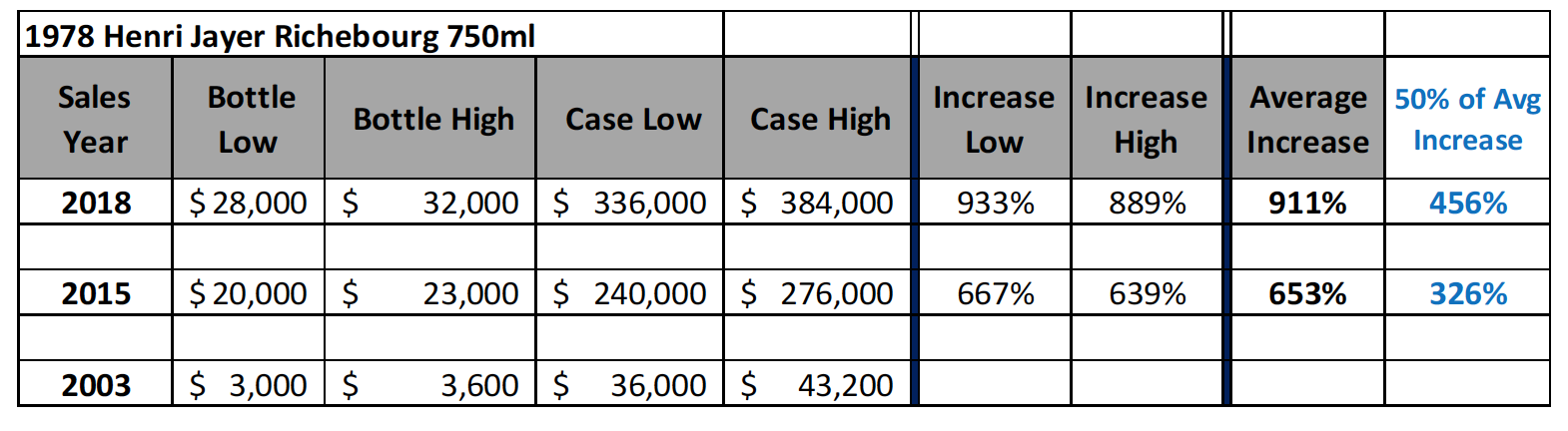

In 2003 the per bottle estimate would be $3,000 – $3,700.

Extend that out to the case and you get $36,000 – $44,400.

In 2015 the per bottle estimate would be $20,000 – $23,000.

Extend that out to the case and you get $240,000 – $276,000.

A 653% increase over the 2003 value.

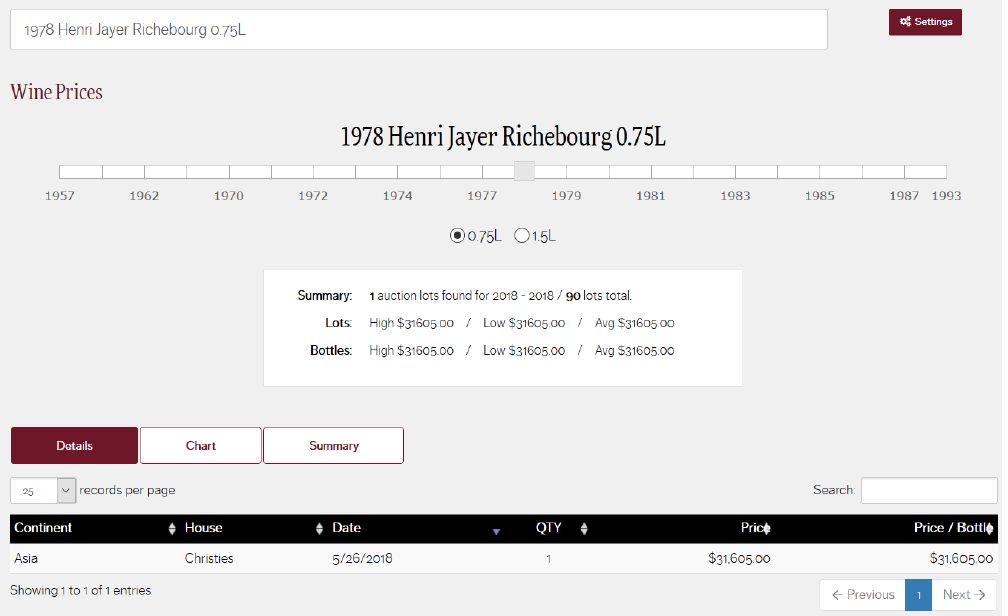

In 2018 the per bottle estimate would be $28,000 – $32,000.

Extend that out to a case, and that is $336,000 – $384,000.

A 911% increase over the 2003 value.

It is a 140% increase just over the 2015 value.

SUMMARY

The confirmable amount of RK sales, at time of sale, as supported by banking records, known consignment revenue and court evidence, comes to $105 million. Because we are missing 81.7% of the time/banking data to see what was paid in, and 53.2% of known auction consignments sales revenue, plus a myriad of other sales for which we have zero data despite knowing they occurred, it is fair and necessary to add in some amount to represent the considerable missing sales data.

Here is where I make the only assumption in all of my math: To account for the missing combined 67.5% of sales/payments data plus untold other sales for which we have absolutely no records, I am making the assumption that we can extend that $105million, out by 24% – 43% to represent all the missing sales and value of sales for which we have no numbers. This brings total value of sales at time to sale to a range of $130 – $150 million. When we then apply the extension of current value using the example of 1978 Richebourg, and supported by the increase in the 1929 Petrus, we comfortably arrive at the following numbers:

Low Estimate High Estimate

$130,000,000 – $150,000,000 The range in value – at time of sale – of the wine Rudy K sold.

$424,305,556 – $489,583,333 Value of Rudy K made wine that still exists in the market, using above sale value, and an average of a 326% gain in value to 2015.

$592,222,222 – $683,333,333 Value of Rudy K made wine that still exists in the market, using above sale value, and an average of a 456% gain in value through current market 2018.

By this calculation, which is based on evidence not pure conjecture, $550million is a middle figure in these estimates. It represents an increase in value of 370% across all items over time in the middle of the range.

Considering that Rudy K was making the rarest, most sought-after wines in the world, and doing so in a prolific manner, and that many items he made have gained in value over time as much as 900%, I believe these to be reasonable numbers. Now – if you also consider that the full scope of his counterfeiting, which is far from understood by those of us that have studied it most carefully and with the most data possible but who are still missing the vast majority of sales information and records, and that so many wines he made have sky rocked in price as have the wines of Henri Jayer and his #1 production Domaine de la Romanée Conti – it becomes clear that it is not unfathomable to assess a 370% increase on a $150million production figure. Especially when you consider that Rudy was faking, and trying to get me to sell, 1947 Petrus and Lafleur as far back as spring of 2002.

I stand by the math my team and colleagues and I have put together.

Rudy Kurniawan evidence is available to members here.